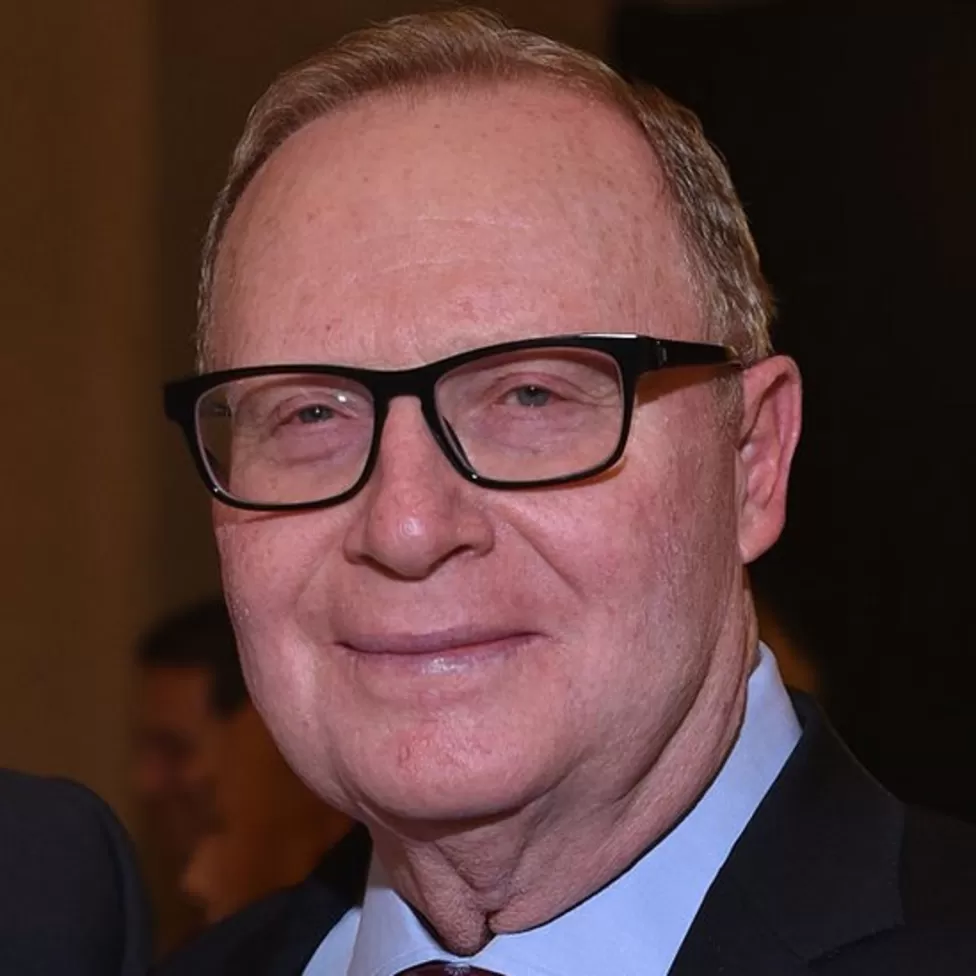

A US billionaire financier, Thomas H. Lee, who helped pioneer the debt-fuelled corporate acquisition known as a leveraged buyout has been found dead.

In a statement, Thomas H Lee’s family said they were “extremely saddened” by the 78-year-old’s death.

According to the New York Post, he died from a self-inflicted gunshot wound at his Manhattan office.

He was found dead on Thursday morning at 767 Fifth Avenue.

The address is where the offices of Thomas H Lee Capital LLC are listed.

According to Forbes, Mr Lee was worth $2bn (£1.6bn) at his time of death.

In a statement, police said they had responded to a 911 call shortly after 11:00 (16:00 GMT) on Thursday morning from an office on Fifth Avenue.

“Upon arrival EMS [Emergency Medical Services] responded and pronounced the male deceased at the scene,” they said.

A statement by family friend and spokesman Michael Sitrick said: “While the world knew him as one of the pioneers in the private equity business and a successful businessman, we knew him as a devoted husband, father, grandfather, sibling, friend and philanthropist who always put others’ needs before his own.”

Alongside his pioneering of the leveraged buyout, Lee was also known for acquiring beverage company Snapple in 1992 and selling it two years later to Quaker Oats for $1.7bn – 32 times what he bought it for.

Lee was also celebrated for his philanthropy, and had served as a trustee for prominent New York City art organisations like the Lincoln Center for the Performing Arts and the Museum of Modern Art.

In 1996, he donated $22m to his alma mater Harvard University, part of which has been used to provide financial aid for students.

“I’ve been lucky to make some money. I’m more than happy to give some of it back,” he said at the time.

He is survived by his wife, Ann Tenenbaum, and his five children.